Natural Resource Partners LP (NYSE: NRP)

A wonderful tollbooth with bulletproof downside protection and mind-boggling growth potential trading at a fair price

I am a longtime reader of John Huber’s writings, which used to be free but are now partially paywalled. His musings on value investing and specific company analysis are, in my opinion, equally original and telling.

This past January, he published a post on a company with some very peculiar characteristics: in John’s words, it gets a cut of sales volume produced by others, [boasting] 90% FCF margin, taking no risk, needing no capital, but still can grow earnings/share, etc. Just as I was dying to learn more about this company, including its name, the remainder of the post was locked for a paid reader, which I am not.

It did not take me long to figure out that the company in question was Natural Resource Partners LP (NRP) based on the hints given by John. I try to train myself to look at a stock with an intention to reject it in the first place and do so as quickly as possible. But I could not do that with NRP.

The reason that I give a stock a pass is more often than not some sort of uncertainty inherent in the investment thesis. But there was very little, if any, uncertainty around NRP, a theme, as we shall see, that permeates different aspects of the business. I have yet to decide if this stock is a ‘yes’ or ‘no’ for myself, but NRP as a business lends itself to evaluating its management and future prospects with a reasonable degree of certainty. That alone is a compelling reason for an astute investor to examine the stock and form his or her own opinion about it. Below I present my on-going attempt to understand and evaluate NRP as a potential investment candidate.

Not-So-Humble Beginnings

NRP was formed in 2002 by Corbin J. Robertson, Jr., who has been managing the business ever since. But its seeds were sown in early 1900s by Hugh Roy Cullen, Robertson’s grandfather and one of the most successful wildcatters in US history.

Starting in oil business in 1918, Hugh Roy Cullen discovered his first oil producing field in 1921. He went on to build a big oil and natural gas empire that found and produced over 1.5 billion barrels of oil equivalent, bolstered by the discovery of 1 billion barrel Tom O’Connor Oil Field.

In 1957, Corbin J. Robertson Sr., who married one of Cullen’s daughters, took the throne. He diversified operations and made it a $1 billion business. But it was his son Corbin ‘Corby’ J. Robertson Jr. who changed everything for good. Having inherited a portion of the family’s big oil fortune, Corby Robertson invested it all in coal in the 1980s - The petroleum business was eventually wound down.

In 1986, Corby Robertson formed Western Pocahantas Properties LP which acquired all of the coal, timber and surface rights of CSX Corporation and New Gauley Coal Corporation for $122 million. Even bigger acquisition took place in 1992, where he formed Great Northern Properties LP that paid $80 million for all of the coal-related assets of Burlington Northern Railroad amounting to some 20 billion tons of coal reserves scattered across a few states. Great Northern Properties’ 20 billion tons of coal is second only to Uncle Sam’s 92 billion tons making Corby Robertson the largest owner of coal in the United States outside the federal government.

In 2002, Corbin J. Robertson Jr. folded around 1 billion tons of his coal reserves into Natural Resource Partners LP, a partnership with Arch Coal, the second largest coal producer in the US. 45% of NRP’s assets were contributed by Western Pocahantas Properties, 14% by Great Northern Properties, and 40% by Arch Coal. 20% of NRP units were simultaneously sold to the public for $90 million, including 8.5% that represented Arch Coal’s interest as the selling unitholder. As a result, the companies under Robertson’s control got to own 46% of NRP units, Arch Coal 34%, and the public 20%. Having contributed sizable reserves to NRP’s assets, Arch Coal today remains one of the largest five coal reserve owners in the US.

Business Model

Although NRP reports revenues in two segments, Minerals Rights (80% of revenue) and Soda Ash (20% of revenue), it is the former that is their core business.

Their exposure to Soda Ash is through 49% non-controlling equity interest in Sisecam Wyoming that mines and processes trona ore into soda ash in Wyoming’s Green River Basin. It is one of the largest and lowest cost soda ash productions in the world. About half of Sisecam’s sales are made in domestic markets and the other half in international markets. Sisecam Wyoming pays quarterly cash distributions that contributes directly to NRP’s top-line. NRP acquired the interest in the soda ash producer in 2013 for $292.5 million. Since then, Sisecam Wyoming has never had a year failing to pay distributions with dividends reduced for two years during Covid - Total Soda Ash distributions NRP has received thus far amount to $505.9 million.

NRP’s core Mineral Rights business refers to the ownership of approximately 13 million acres of mineral interests and other subsurface rights across the United States, but primarily earns revenue from coal royalties. In other words, NRP principally acquires coal properties, leases them to coal producers, and collects royalty payments in exchange. The royalty rate is generally set to be, on average, 6.5% of the gross sales a lessee generates from coal extracted from a certain lease. Operating expenses, capital costs, and other liabilities arising out of production activities are borne entirely by the lessees of the coal properties. This royalty business model detaches NRP from operational burdens so well that the partnership has free cash flow (FCF) margin north of 85%.

The majority of the lessees are contractually obligated to make minimum payments to NRP even if mining activities are temporarily ceased. The payments so made are credited against future royalties to be collected when mining activities resume. But the lessees are time limited on the period available for recouping the minimum payments. This arrangement not only provides NRP with some financial cushion during significant coal price and demand declines but also serves as a strong incentive for the lessees to keep producing and paying handsome royalties to NRP.

Turbulent times are inevitable, especially in minerals industry characterized by its infamous boom and bust cycles. When coal demand or price plummets NRP is hurt but does not bleed as badly as, say, coal producers do. In a sense, it is a ‘Heads, I Win; Tails, I Don’t Lose Much’ setup. What NRP has managed to achieve over the years is dependable coal royalty revenue streams with bulletproof downside protection. The proof is the fact that NRP has generated respectable FCF year after year since its formation in 2002. Its FCF generation over the last 21 years amounts to $4.2 billion.

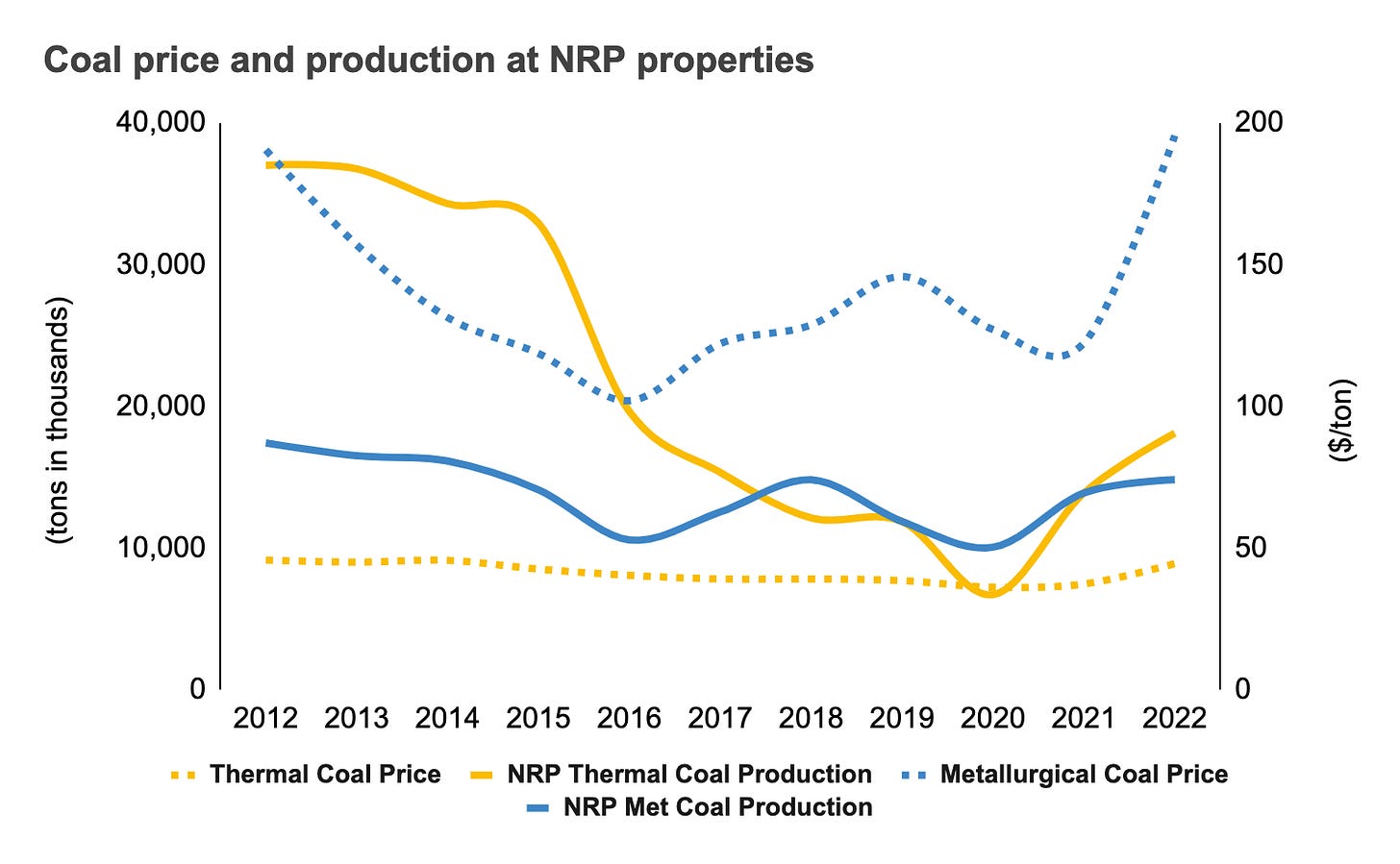

NRP collects almost half of its coal royalties from metallurgical coal production in Northern, Central and Southern Appalachian regions of the United States and the other half from thermal coal mines located largely in Illinois and to a lesser extent in Montana and Appalachia.

Metallurgical coal production would likely remain the main driver of FCF generation for NRP for the foreseeable future. That is because the technology to replace metallurgical coal in manufacturing primary steel is in pilot phase and would not be commercially available any time soon. New mines also hardly come online as NIMBYism makes the permitting of green field projects onerous, while the resource is finite.

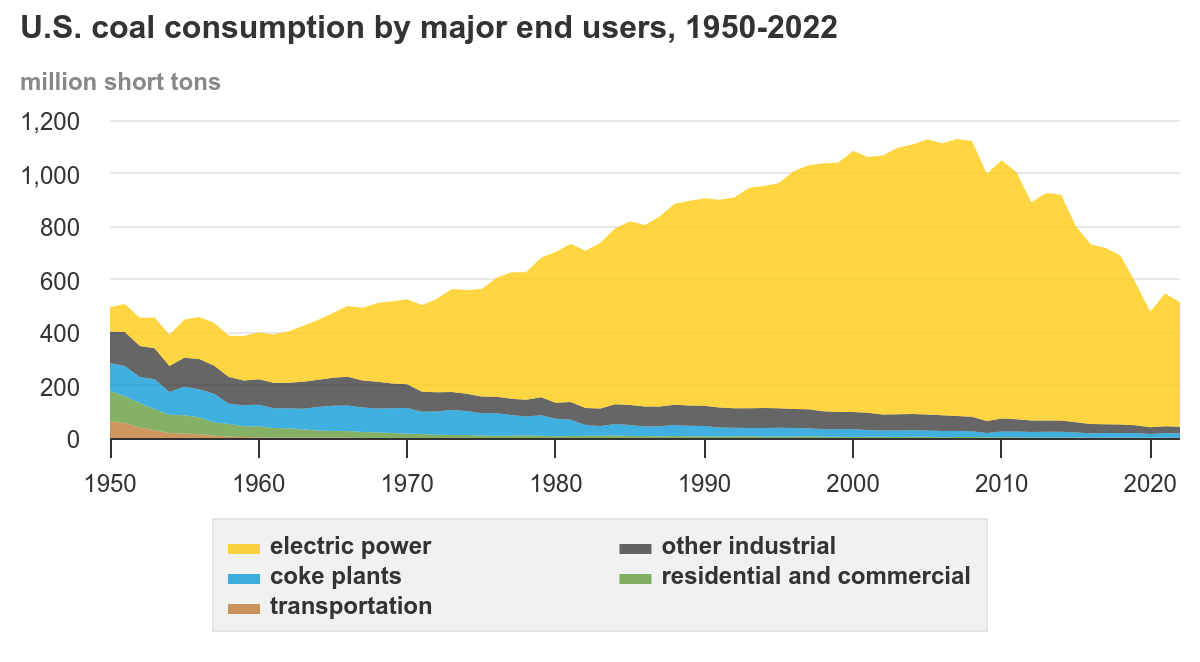

Thermal coal, on the other hand, is in secular decline, especially in the US, a trend likely to persist for environmental and economic reasons. But it helps that NRP’s properties within Illinois basin, which account for the majority of its thermal coal royalties, are the most cost-efficient mines east of the Mississippi River. This gives the otherwise declining segment of the business some competitive strength.

At any rate, NRP’s carbon neutral initiatives, which we shall discuss below, have the potential to make up for the diminishing coal royalty streams in the decades to come.

Industry Dynamics

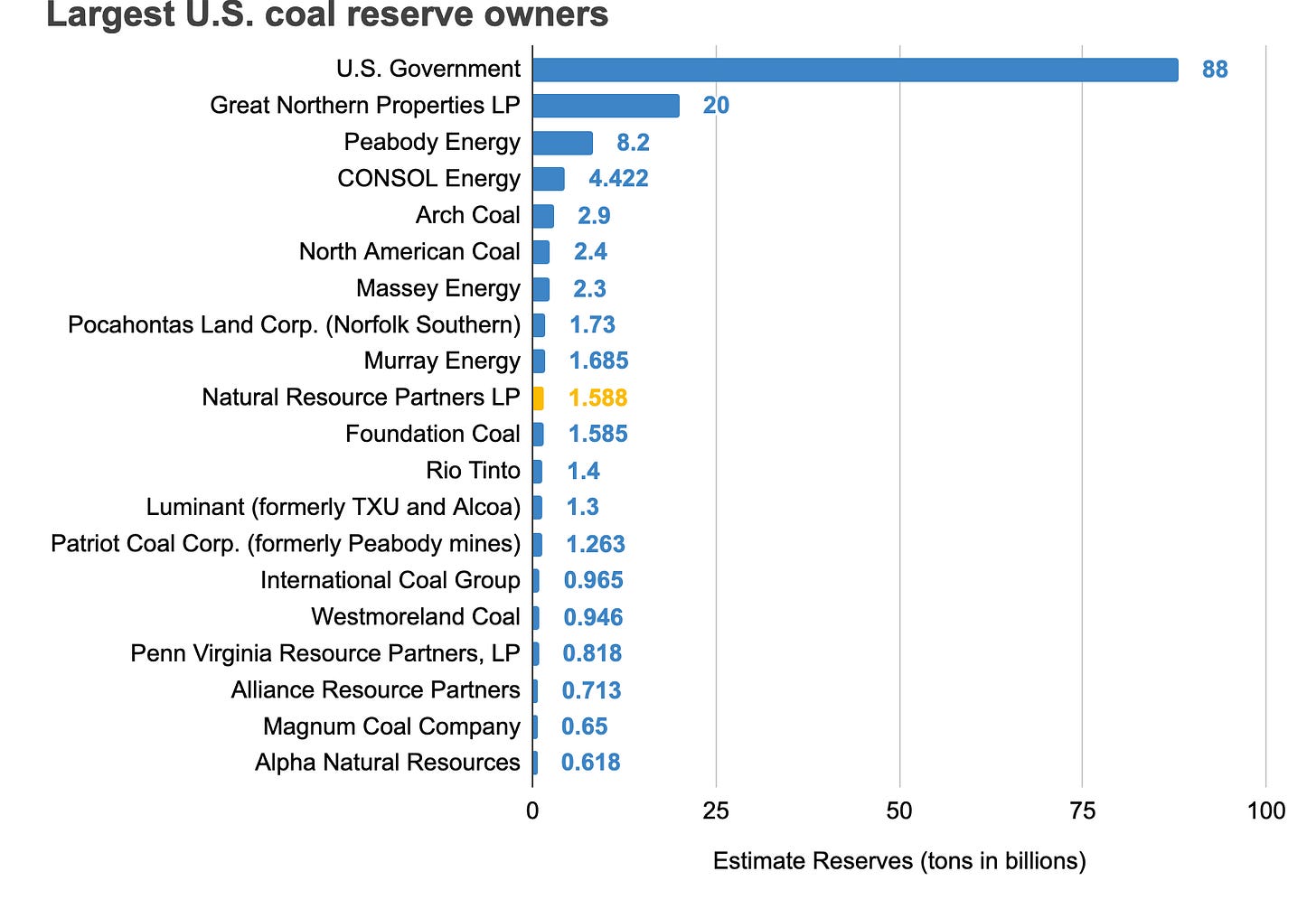

NRP no longer publicly discloses any information regarding coal reserves that it owns. According to the latest available data, NRP is one of the ten largest coal reserve holders in the US outside the federal government owing to its ownership of about 1.5 billion tons of coal. From the production standpoint, on average, 4.5% of US total coal and 21.5% of the country’s metallurgical coal production comes from NRP properties.

That is no minor market share. But bigger is better only if the enterprise is reasonably profitable. From its inception through 2015, NRP passed the profitability test with flying colors.

Prior to 2015, NRP paid out, on average, 80% of its distributable cash flow (DCF), while increasing DCF by 18% per annum thanks to a decade of acquisition spree. The acquisitions were fueled by loans for the short term and for the long term by issuing debt and additional units. Internal cash flow was hardly used for acquisitions but paid out to unitholders almost entirely so that NRP did not lose face in the equity markets. As a result, NRP built, on top of coal, a portfolio of aggregate, oil and gas properties, and the aforementioned soda ash producer - It stuck unwaveringly to the royalty business model all the while.

The acquisition math made perfect sense. Please note that the numbers presented below are rounded so that the calculations have ‘back of the envelope’ feel. NRP paid the price of 5 times the current royalty stream when it acquired a property. The capital needed to finance that same deal, on the other hand, is raised at the rates that the partnership meets its cost of capital if it had paid 10 times (issuing units) or 15 times (debt financing) for the same royalty stream. NRP has, therefore, proven to be capable of creating excess value at scale.

By all accounts, US coal mining, of which NRP is a key player, is a fragmented industry that is also declining. ‘Operating’ in a declining industry is not as a bad luck as it seems for NRP because, sitting on top of some 1.5 billion tons of coal reserves and at the current run-rate production of 50 million tons, it can pursue a Harvest strategy quite profitably for the next 30 years. That is the worst case scenario and NRP could grow either organically (more on this later) or through M&A in the future as it did in the past.

The fragmented nature of the industry, on the other hand, posses a challenge to NRP. The industry has undergone considerable consolidation since 1976. The top ten producers had increased their share of total US coal production from 38% in 1976 to 65% in 2007. As a result, only a handful of lessees generate approximately 75% of NRP’s coal royalty revenues as of 2023. For instance, royalties paid by Alpha Metallurgical Resources make up 30% of NRP’s coal royalty revenues, Foresight Energy Resources 20%, Hatfield Metallurgical Coal Holdings & Ramaco Resources 18%, Rosebud Mining 7%, a mix of private metallurgical and thermal coal producers the remaining 25%. Customer concentration of this magnitude poses a risk of losing large portion of revenues should the significant customers’ sales drop. Those significant customers may also posses some bargaining power to negotiate royalty rates with NRP.

In coal royalty space, the buyer and supplier are more often than not the same entity: the coal producer. From the US coal ownership chart above, one can see that it is the coal producers who are largely the coal reserve owners, save for an investment partnership or two. When NRP acquires a coal property, it is, therefore, generally a win-win transaction where a coal producer gets to sell its coal reserve at a better valuation than otherwise available and NRP pays for the same coal royalty stream way below its cost of capital as mentioned above. As a result, the power of a supplier can be practically disregarded as far as NRP’s business model is concerned.

A far more real threat to a coal royalty business is non-consumption or weakness in coal demand that manifests itself in declining coal price. The use of thermal coal in electricity generation in the US keeps declining owing primarily to the significant reduction in natural gas prices relative to that of coal. Another contributing factor is increased generation from wind and solar driven by federal subsidies and backed by lower costs. If one wants to make steel without using metallurgical coal, the technology is basically there, although it would be expensive. Until the economics works for such alternative techniques for making green steel, substitution threat remains less pronounced for met coal compared to its thermal counterpart.

NRP maintains that its competitors in purchasing royalty producing coal properties include land companies, coal producers, international steel companies and private equity firms. That is a diverse set of businesses competing in a same industry. Differing financial objectives, incentive structures, time horizons, etc. of those businesses could result in rather intense rivalry among them. The reason is that, being decidedly different from its peers, each one of them is more likely to think and act individualistically making coordination among them difficult.

Key Person

Corbin J. Robertson Jr., now 77, has been the biggest unitholder of NRP and Chairman and CEO of its managing general partner ever since he formed NRP in 2002. He and his family business together own 34.3% of the outstanding common units. He is not only an industry veteran with four decades of experience but also every inch an Outsider CEO. Corby Robertson writes in his last letter to unitholders:

We think long-term. We do not provide quarterly guidance or concern ourselves with meeting short-term earnings expectations. Our focus is on maximizing the Partnership’s earning power over five, ten, fifteen years, and beyond. We believe this is the best approach to maximize the intrinsic value of our business, which should in turn maximize the long-term return on your investment.

Robertson is believed to own the biggest share of US coal reserves through his various ventures outside the federal government. As such, he must be immune to ‘empire building’ that so many CEOs fall prey to. By the same token, he must have done the many acquisitions he made prior to 2015 only because he saw opportunities to maximize value per unit.

He also understands that a CEO’s top priority is to try and widen the business’s moat every year. As a case in point, he did something that helped reduce NRP’s cost of capital significantly in 2010. That was the elimination of all the incentive distribution rights (IDRs) held largely by him through NRP’s general partner and its affiliates. Prior to that, the IDRs received 24% of cash distributions and 48% of any increase in distribution. With IDRs eliminated, Corbin Robertson remains incentivized to maximize NRP’s earning power. He writes:

We believe that as your partner, our economic interests should be aligned with yours. Every member of your executive team has a meaningful portion of their net worth invested in NRP. Collectively, your executives and Board of Directors own 29% of our outstanding common units. Rest assured that our investment goals are closely aligned with yours.

Catalysts

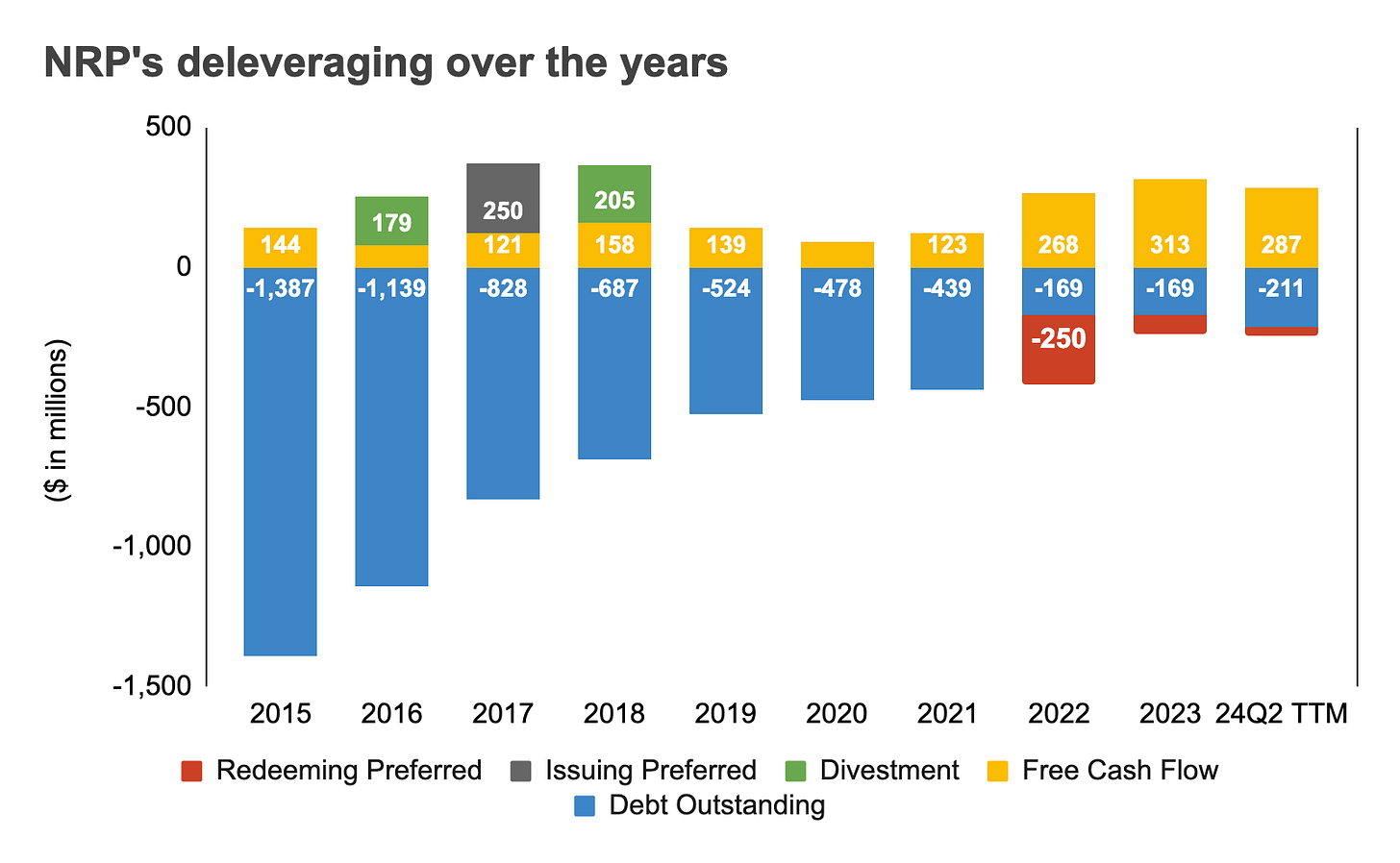

Analysts and the management keep pointing out that there are two strategic changes taking place at NRP. The first one is paying out outstanding debt and redeeming all of the convertible preferred units they issued in pursuit of the former. NRP has been executing this strategy flawlessly since 2015 and appears to be very close to concluding it with a great success. Please refer to the graph below, which, I hope, tells the story clearly.

Being a function of ever-changing coal demand and price to start with, NRP’s revenues have been affected by several big events in the last decade: downturn in the coal market followed by NRP’s divesting its oil & gas, aggregate & mineral properties in 2016, and VantaCore aggregate business in 2018, and ensuing Covid pandemic lasting for a couple of years.

That makes it hard to come up with a reliable estimate of how much revenue NRP normally generates per annum. Meanwhile, NRP’s outstanding debt, including the fraction of preferred units yet to be repurchased, currently stands at $243 million. If one uses their trailing twelve months (TTM) revenue of $287 million as a proxy, NRP might be able to pay down all of its debt in a year or so. Becoming debt free is indeed NRP’s top priority. Their latest investor presentation reads:

Our goal is to retire the remaining $32 million of preferred equity and pay off all debt. Once all obligations are eliminated, common unitholders will have no competing claims on the Partnership’s Free Cash Flow.

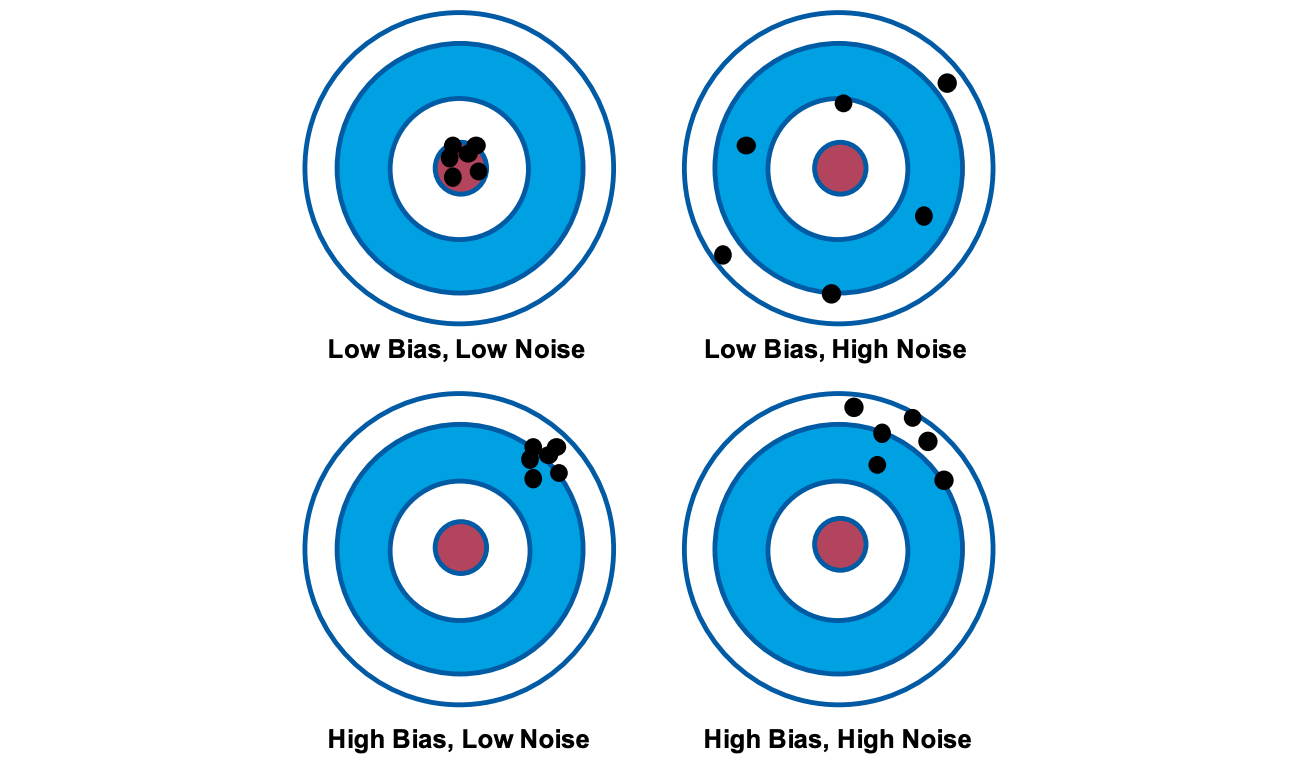

If it takes a year or a few more to achieve that is anyone’s guess. But the key point here, I believe, is that it is not a matter of if, but when, and it likely happens in the not too distant future. That is a pretty ‘low bias, low noise’ prediction one can make, in my opinion. Achieving this strategic goal would likely result in material increase in distributions paid to NRP’s unitholders.

The second strategic shift that takes place at NRP is that they are determined to redefine their business as a key player in the U.S. transitional energy economy in the years to come. Being rooted in the country’s long-term strategy to achieve carbon neutrality or net-zero emissions no later than 2050, the transitional energy sector offers many areas of potential growth or incremental revenue for NRP.

That include generation of electricity using geothermal, solar and wind energy, sequestration of carbon dioxide underground and in standing forests. NRP has thus far executed leases or projects in all of those areas but wind power generation. In embracing the new business opportunities, NRP has no interest whatsoever to give up the old royalty business model of theirs. Here is a statement found on their website:

As with our existing mineral activities, we do not plan to develop or operate carbon sequestration or carbon neutral energy projects ourselves but lease our acreage to companies that will conduct those operations in exchange for payment of royalties and other fees to us.

Simply put, energy transition refers to more wind, solar and other renewables and less coal, oil, and gas in the mixture of the sources for energy generation. NRP started partaking in this transition in Q3 2022, when it executed its first geothermal lease with the potential to generate 15MW of electricity. With estimated revenues of over $20 million and at assumed royalty rate of 5%, this lease alone could pay NRP $1 million of incremental royalty revenue per annum. NRP also executed a solar lease for the first time in Q1 2023.

But experts tend to agree that the United States cannot accomplish carbon neutrality prior to 2050 by simply moving away from fossil fuels, not unless it develops capabilities to decarbonize fossil fuels to turn them green. They are certain that carbon capture, utilization and storage (CCUS) industry must be established and play a big part.

The idea is to figure out a way to capture carbon from smoke tanks, as is already done for mercury, sulfur, and NOx, and then injecting the carbon so captured into underground pore space for permanent sequestration. The last bit (e.g. injecting carbon dioxide to subsurface oil reservoirs) is something the state of Texas has been doing over the last 40 years.

In Q1 2022, NRP executed its first carbon sequestration lease with Denbury on 75,000 acres of subsurface pore space located southwest Alabama with the potential to store 300 million tons of carbon dioxide. In Q4 2022, they announced the execution of their second underground carbon storage lease with Oxy Low Carbon Ventures involving 65,000 acres of pore space near southeast Texas with estimated carbon dioxide sequestration capacity of at least 500 million tons. That is a total of 140,000 acres of pore space under lease for sequestrating up to 800 million tons of carbon dioxide with injection is anticipated to commence towards the end of this decade.

US tax credit for CCUS activities is currently $85 per ton of carbon dioxide permanently sequestrated underground. By Corby Robertson’s estimates, the industry could afford to pay 6.25% of the same tax credit in royalties to the pore space owners. At such rates, NRP could realize $4.2 billions of royalty revenue between the two carbon sequestration leases it has executed thus far - That amount equals the total FCF generated by the business over the last 21 years. Those leases represent only 4% of the 3.5 million acres that NRP has at its disposal for carbon sequestration as the owner of both surface and underground rights. Moreover, the remaining 9.5 million acres of NRP’s underground rights could be put to the same use with the royalties shared 50/50 with the surface owners.

Even if CCUS industry develops the perfect technology to capture every carbon atom in smoke tanks, there will always be carbon emitting from tail pipes. That is what carbon offset credits are for. The idea is that the forestland owner receives carbon offset credits appropriate for the amount of carbon ‘eaten up’ by standing forests. The credits can subsequently be traded between entities.

In Q4 2021, NRP executed its first carbon neutral transaction where it received and sold 1.1 million forest carbon offset credits for $14 million. The offset credits were issued by the California Air Resources Board and were attributed to 1.1 million tons of carbon sequestered in approximately 39,000 acres of NRP’s forestland in West Virginia.

America’s energy policy is usually defined as being ‘all of the above’: the country utilizes all available sources of energy, both renewable and nonrenewable. The same catch phrase seems to apply to the nation’s decarbonization efforts: it ought to be all of green energy, CCUS, and carbon offset credits. But everything else remains uncertain.

NRP appears to be poised to successfully navigate the uncertainty, judging from how skillfully they have put together a portfolio of transitional energy leases and projects in just last couple of years. What is more, NRP seems to do in the nascent US decarbonization space, what Diageo does in the global premium alcoholic drinks industry. Graham Rhodes does a great job in summarizing Diageo’s strategy in a piece he has recently published:

The best description of Diageo I’ve heard is that it is an index of Western consumers’ ever-changing alcohol preferences, moving with them as they flit from whiskey to tequila to vodka to the next new thing. Diageo’s business model is built around volume and availability.

Even if it is not explicitly articulated, NRP clearly aims at ensuring that they reap the biggest economic benefits, regardless of whether the U.S. transitional energy economy plays out one way or another and how that changes over time, thanks to its massive holding of acreage scattered across the United States. Such, to me, is a very ‘low bias’ strategy one can pursue when entering an inherently ‘high noise’ industry.

Valuation

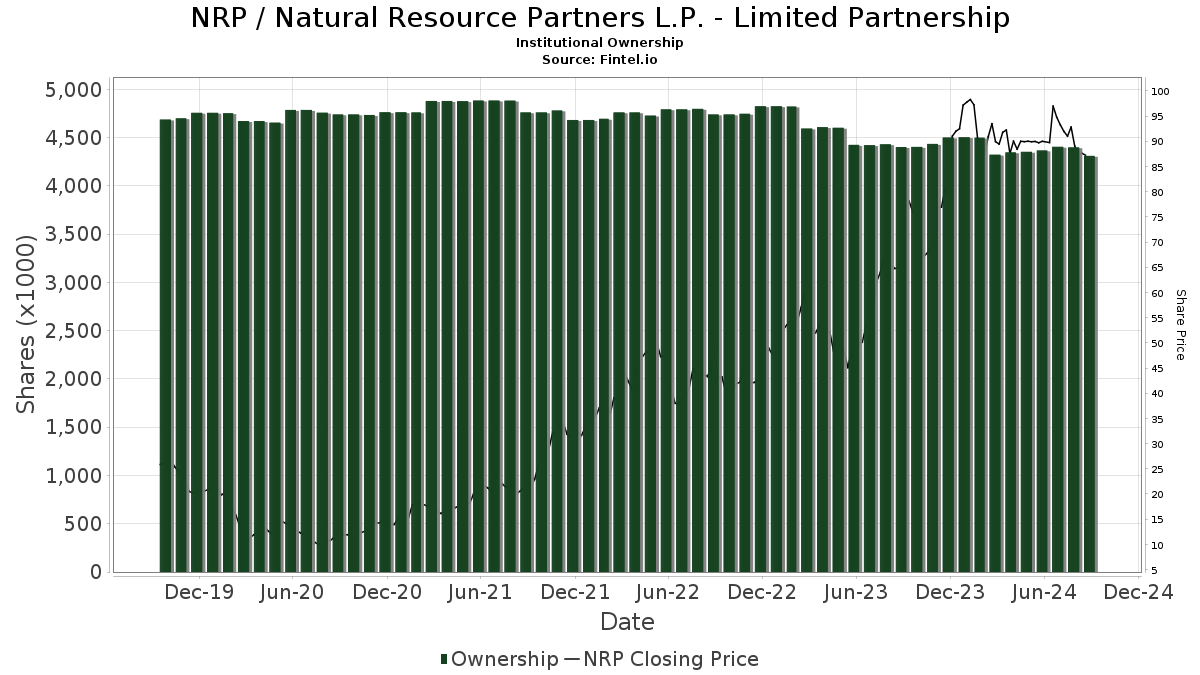

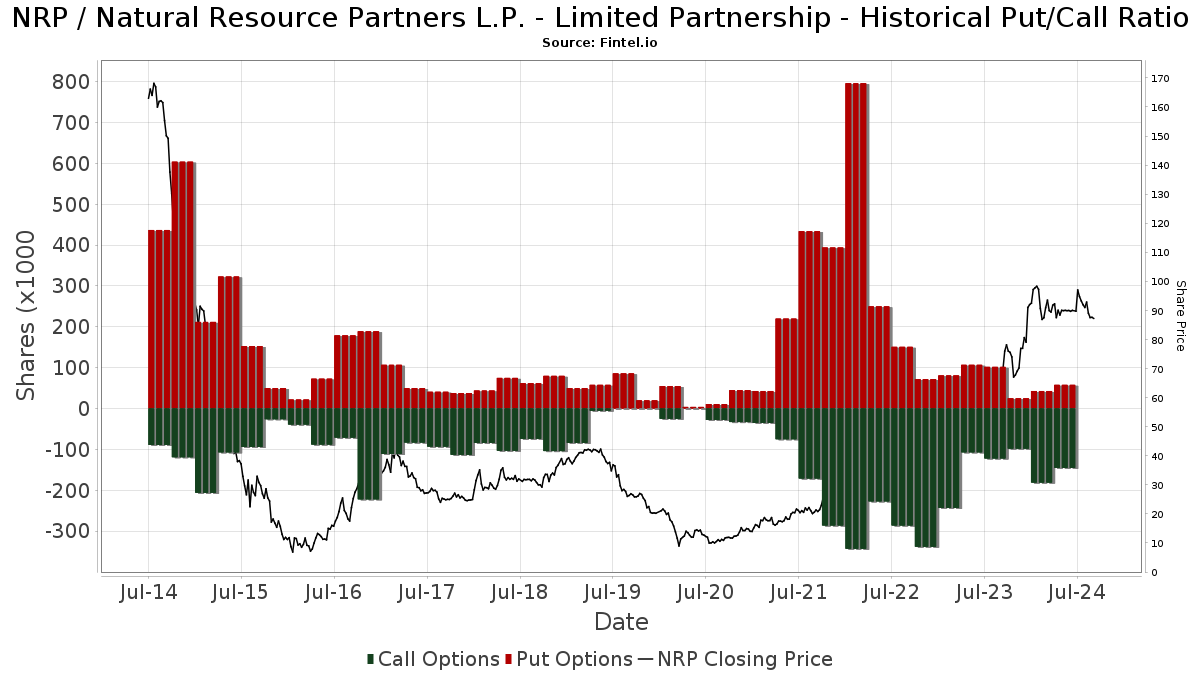

Some analysts suggest that, being a pure play coal royalty stock, NRP offers no-nonsense exposure to metallurgical coal markets for some institutional investors. As a result, NRP stock could possibly be bid up by the same investors to ridiculous levels of multiples from time to time. However, historic data paints a different picture.

Over the last five years, institutional ownership has remained more or less constant at one third of NRP’s outstanding units, while the unit price has increased more than three times. NRP’s unit price is much more sensible to market expectations as evidenced, for example, by institutional put/call ratio - Generally speaking, put options indicate negative sentiment and call options positive outlook.

NRP paid special distribution of $2.45 per unit in 2023 and again in 2024 to help cover unitholder tax liabilities associated with owning NRP's common units. Excluding those special distributions, as such are not really dividends per se but designed merely to offset pass-through tax liabilities for a unitholder, NRP currently trades at a dividend yield of 3.25%. By contrast, NRP’s historical dividend yield is, on average, 9%.

The gap between the current (3.25%) and historical (9%) dividend yield and NRP’s current unit price of around $90 suggest that, the way Mr. Market sees it, NRP’s current distribution to common unitholders of $38 million could rise to $106 million in the short term. NRP could indeed easily afford to pay over $100 million of distribution to common unitholders, once it is free of debt, which, as we have discussed earlier, is bound to happen in the near future. In other words, NRP‘s current price of $90 per unit already reflects the possibility that it would soon be debt-free. Nonetheless, dividend yield of 9%, as both the historical and current valuations suggest, is not bad for a stock like NRP which is very well protected from downside risk, except for the fact that it is in a declining industry.

What is not priced in how the market values NRP nowadays are royalty revenue streams it could realize from carbon sequestration or partaking in the US energy transition otherwise in the future - The marginal cost of realizing such incremental revenue would practically be zero thanks to NRP’s royalty business model. If that happens by the end of this decade, it would be priceless making NRP the ultimate dream business which pays out ever-increasing distributions without retaining earnings. An investor buying NRP at today’s price of about $90 per unit pays nothing for this huge upside and gets to enjoy solid dividend yield of 9% or above while waiting to see if the anticipated revenue growth materializes. NRP stock at the current market price, therefore, offers the kind of asymmetry that defines a profitable investment. As a side note, I personally like how the late Sam Zell explains that investing is all about finding asymmetries:

Listen, business is easy. If you’ve got a low downside and a big upside, you go do it. If you’ve got a big downside and a small upside, you run away. The only time you have any work to do is when you have a big downside and a big upside.

Conclusion

NRP is the epitome of the proverbial toll road business that has proven to generate consistent FCF in both bad and good times. Owing to its royalty business model, NRP knows nothing about any kind of operational risk except for occasional commodity price crises. That makes for a business that has almost zero downside. The sky is the limit when it comes to NRP’s carbon neutral initiatives and their revenue potential. The current market price offers an investor dividend yield of around 10% with no premium paid for the potential revenue growth. Consequently, the investor gets to have her or his cake and eat it too.